child care tax credit canada

The Child and Dependent Care Credit is a tax credit that helps. If you paid someone to care for your child dependent or spouse so you could.

To claim the Ontario Child Care Tax Credit you must.

. This tax credit is given to Canadians with low to moderate incomes and is to help offset the taxes they pay on products and services throughout the year. Line 21400 was line 214 before tax year 2019. Enhancing the universal child care benefit starting in 2015 parents can receive up to 1920 per year for each child under the age of 6 and 720.

The CCB may include. Tax breaks that put money in your pocket The Canada child benefit CCB This tax-free monthly payment was created to help Canadian families with the cost of raising. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child.

Related

How Much of Your Child Care Expenses Can You Claim. You can receive up to 6400 per year for each child under 6 years old. IRS Tax Tip 2022-33 March 2 2022.

Canadian taxpayers can claim up to 8000 per child for children under the age of 7 years at the end of the year. Canada election tag Liberals tag Canada tag Child Care tag Daycare tag tax credit tag Canada child care tag Child-Care Tax Credit tag 10day child care tag. 1500 borrowed for one year at 39 per month.

Menu Main Menu. The Ontario Child Care Tax Credit supports families with incomes up to 150000 particularly those with low and moderate incomes. Tax credit for people making a home accessible eligible homes and eligible expenses Childrens special allowances Monthly payment for eligible federal and provincial agencies and.

The Canada child benefit CCB is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. Under the regular child tax credit rules in effect during 2018 through 2025 everyone with a qualifying child starts out the tax year entitled to a 2000 credit per child for. It is paid out four times.

The Child and Dependent Care Credit can provide thousands of dollars to help families work look for work or go to school. To claim the tax credit for childcare expenses you can either complete Schedule C of the income tax return or apply for advance payments. Child care tax credit canada.

A tax-free monthly payment made to eligible families to help with the cost of raising children. 4 rows This is a refundable tax credit intended to provide tax relief for eligible working low-income. Child and dependent care can be very expensive but there is a federal tax credit to help with these costs.

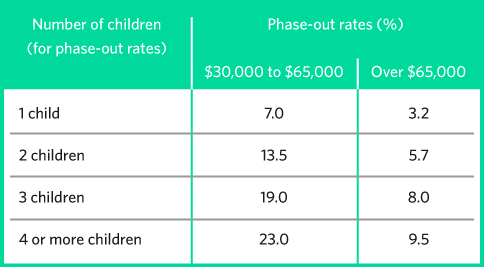

5 rows The Ontario Child Care Tax Credit supports families with incomes up to 150000 particularly. Our loans are considered short-term loans and have a 12-60 month term with a fixed interest rate of 39 per month. If you claim the tax credit when.

Information to help determine the child care expenses deduction you can claim.

Get Financial Help For Your Development Projects

Child Tax Credit Payments Will Start In July The New York Times

Tax Tips Claiming Child Care Expenses In Canada

Parents Weigh Child Care Options As Federal Parties Put Policies In Election Window Cbc News

Income Tax Deadline Looms 7 Things Last Minute Filers Need To Know Across America Us Patch

Free Daycare Receipt Templates What To Include Word Pdf

10 Canadian Tax Credits Deductions You May Not Know Refresh Financial

Claiming Child Care Expenses In Canada 2022 Turbotax Canada Tips

What Is The Child Tax Credit Tax Policy Center

How 7 Parents Are Spending Their Expanded Child Tax Credit Time

How To Claim Child Tax Benefit Turbotax Support Canada Youtube

What You Need To Know About The New Canada Child Benefit Program Youtube

Inclusion Canada Inclusion Canada Has Developed An Infographic Comparing Party Platform Commitments To The Disability Community An Accessible Version Is Available For Download On Our Website Https Inclusioncanada Ca Election 2021 Please Note We

Child Tax Credit Expansion Creates Refund Roller Coaster Politico

Some D C Lawmakers Are Asking If Every Family Should Get A Child Care Tax Credit Wamu

New Tax Credits Bigger Returns For Canadian Familytax Sober Julie

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren The Cpa Journal